Maintain financial records

About the Unit

Learn basic accounting of journals and ledgers, where to post entries and how to reconcile discrepancies.

Prepare a trial balance.

Start with the Study guide BSBFIN302.

What is a General Ledger?

Learning Outcomes:

BSBFIN302-Maintain Financial Records

- Prepare journal entries for posting to general ledger.

- Post journal entries and reconcile discrepancies

- Maintain general ledger

Click on tabs for Learning Content

Accounting Basics

Understanding basic accounting practices will save you money and help you take ownership of your finances and cash management.

As technology develops and more DIY options like cloud- based accounting systems become available, you will be able to do the majority of the work yourself and only refer to a specialist bookkeeper, BAS agent or accountant when you need it.

The bare minimum you must do is:

- Record your sales (income)

- Record your purchases (expenses)

- Chase up any debtors (people that owe you money)

- Keep records in accordance with taxation law (ATO)

- Bank daily

Common accounting terms:

Click on the link below to learn more:

Record keeping requirements of the ATO for Small Business

Five Rules for Record keeping quoted from the ATO website (Overview of record-keeping rules for business | Australian Taxation Office (ato.gov.au))

- Keep all records related to starting, running, changing, selling or closing your business.

- Relevant information in your records must not be changed and must be safely secured and protected from being changed or damaged.

- You need to keep most records for 5 years

- Records need to be shown if the ATO asks for them

- Records must be in English or easily converted to English.

Record Keeping Procedures

Setting up procedures will ensure you avoid any record keeping errors. The ATO have some great advice and tips on how to set up and maintain your records.

Check out the links below:

➡Complete Question 1 & 2 & 4.

What are credits?

Money owed to you

- Accounts Receivable

- also relates to deferred payments offering “7 days credit.”

What are debits?

Money you owe

- Accounts payable= Liability= right hand side (DEALER)

What is a journal?

a record of financial transactions

- entered by order of date

- journal entries are posted into the ledger

What are creditors?

People you need to pay

- Accounts Payable= people you need to pay

What are debtors?

money owed to your business

- Accounts Receivable- debtors owe you money

What is a ledger?

Records and summarises financial transactions

- Journal entries get placed in the ledger as debits and credits to show current balances.

What is double-entry bookkeeping?

Two entries for each transaction

- A positive and a negative, a debit and a credit -so it balances. Both columns need to equal each other.

What is accrual accounting?

Record revenue and expenses before receiving payment

- follows the matching principle of the double-entry accounting method.

What is cash reconciliation?

balancing the books at the end of the month.

Cash reconciliation you might check your bank statement with your monthly accounts payable to make sure that they balance. Money going out of the bank account = your invoices paid for the month.

➡Review Knowledge Question 5

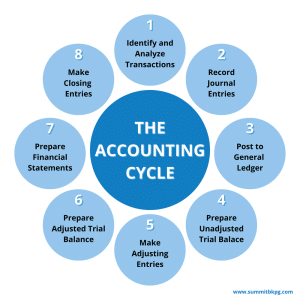

The Accounting Cycle

The accounting cycle is a basic, eight-step process for completing a company’s bookkeeping tasks. It provides a clear guide for the recording, analysis, and final reporting of a business’s financial activities. It consists of 8 steps.

➡Review Question 2

Principles of Double entry bookkeeping

Double entry bookkeeping works on the accrual method of accounting.

- One transaction has 2 entries.

- Every Debit needs a Credit.

- Money In needs to show Money Out.

- Assets = Liabilities + Equity

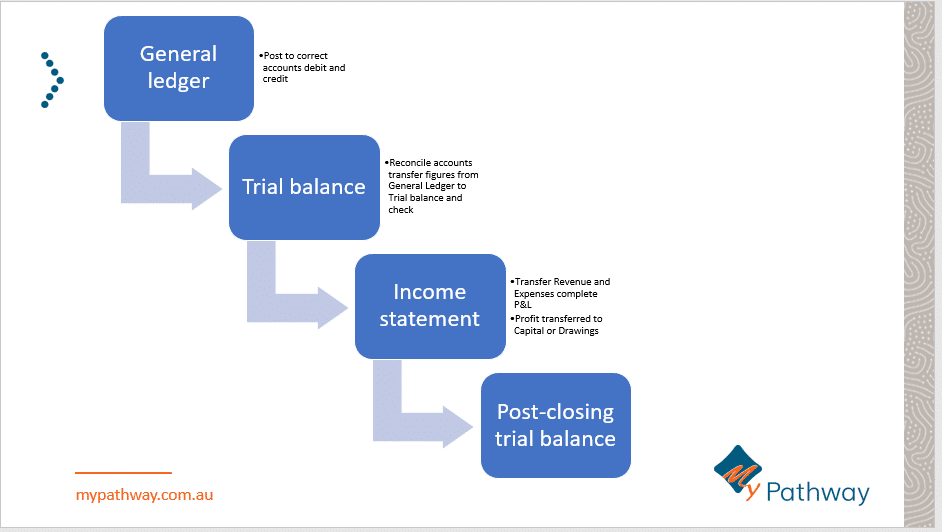

In the Assessment 2 Tasks you will record journal entries(1+2), post to the General Ledger (3), conduct a trial balance (4), prepare the income statement (7) and conduct a post-closing trial balance (8).

Figure 1: The bookkeeping process to follow every month

Task 1-Prepare Journal entries

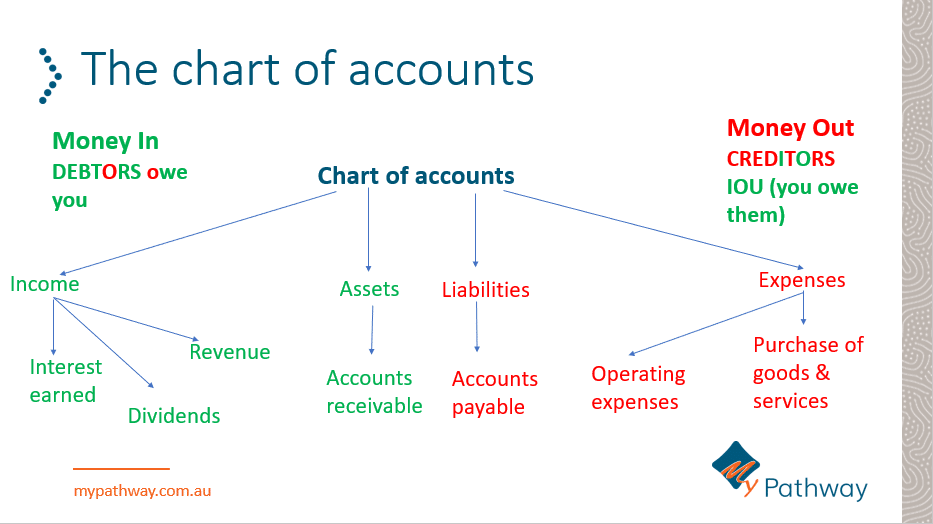

Identify money coming in and money going out of your business. What accounts do you need in your Chart of Accounts? The Chart of accounts is split into:

- Assets/ Revenue/Equity/Capital (Money In)

- Liabilities/Expenses (Money out)

Figure 2; The Chart of Accounts

Shows the “money in” side of the accounts in green and the “money out” side in red.

**Note Debtors owe you money so it is money in and Creditors you owe money so it is money out.**

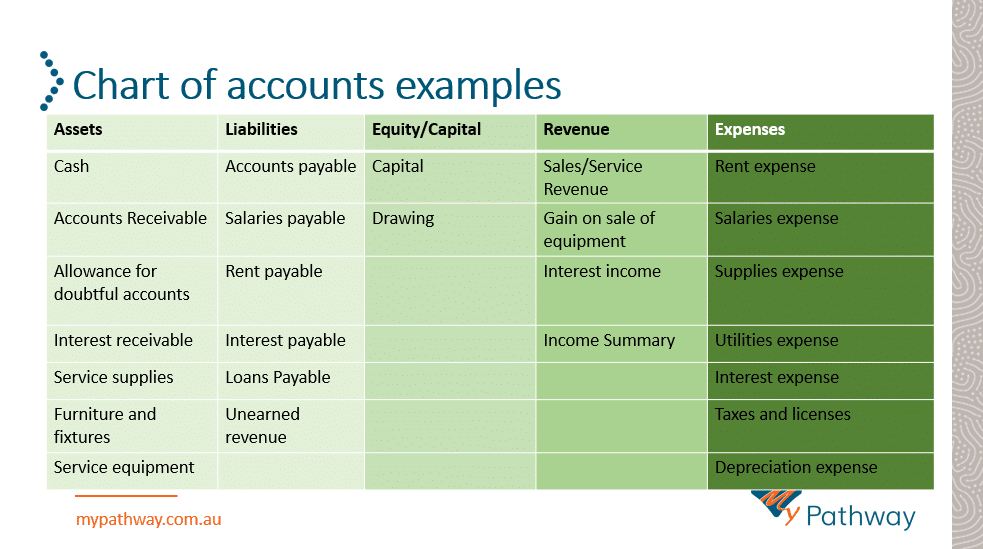

Figure 3: Examples of Account names you could choose to use

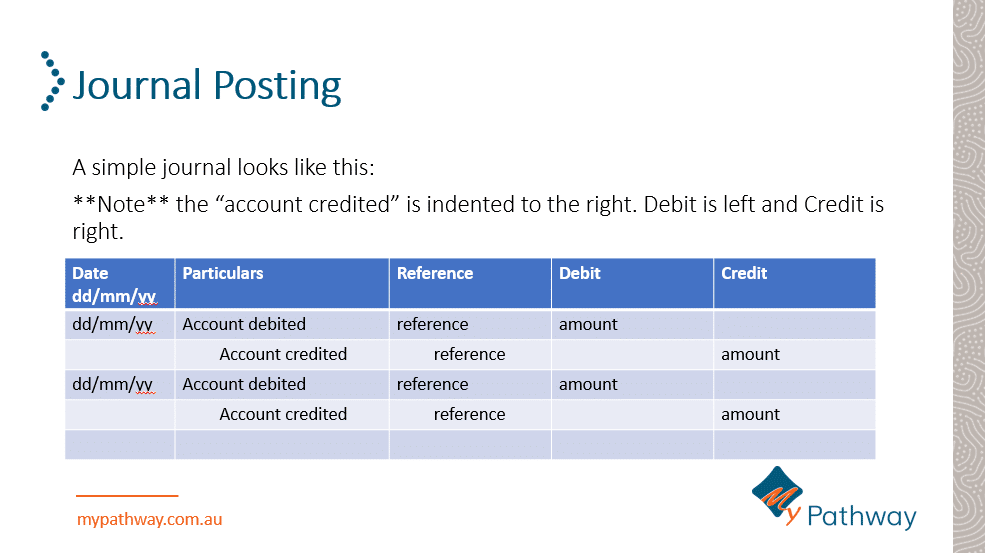

Figure 4: The Journal Layout for Debits and Credits.

***Debits are always on the Left and Credits on the Right.***

Post Journal entries- Debits & Credits

Accrual or double-entry bookkeeping requires you to enter 2 entries for each transaction. You need to show where the money comes in and where it goes out.

EVERY DEBIT HAS A CREDIT.

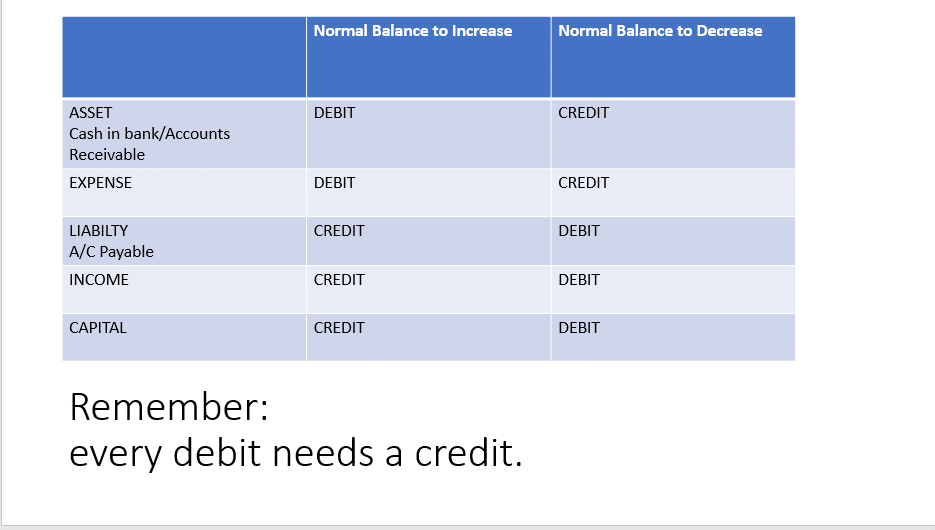

The table below will help you determine whether to debit or credit the account. You need to make sure you use the correct account.

- Accounts Receivable is an ASSET because you will receive the cash in the future.

- Accounts payable is a LIABILITY because you owe money .

The Rules of Debit & Credit

Figure 5: The rules of debit and credit

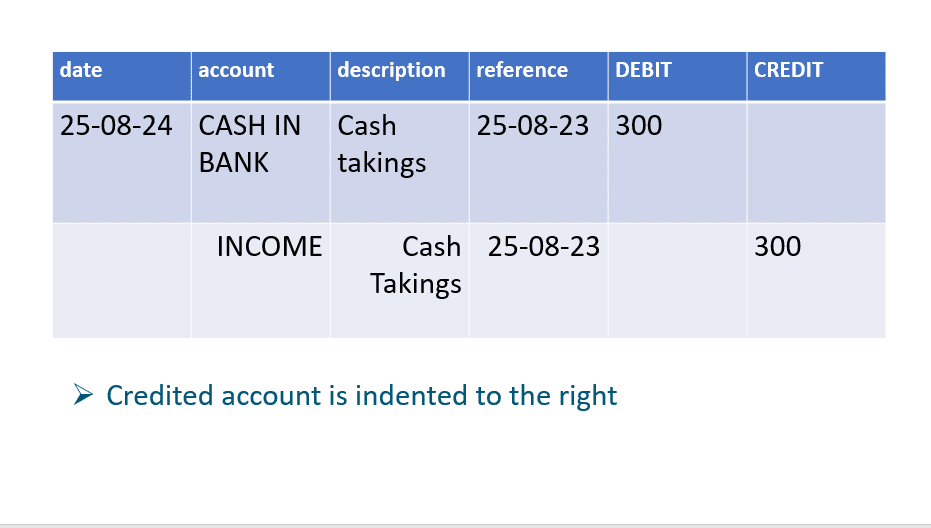

Example 1: Todays cash takings are $300.

- Which account do we debit and which do we credit?

Let’s use the table above to work this out.

Money came in as sales. This is also known as Revenue or Income. $300 cash came into the business as Income.

- Our income balance increased by $300.

- Table above says if income balance increases, then we need to credit the Income account.

- Every Credit needs a Debit.

- This cash will now be banked at the close of business. Cash in Bank will increase by $300. Table says Cash in Bank balance increases, we need to Debit the Cash in Bank Account.

Your Journal entry will look like this:

Figure 6: Example of journal entry for one transaction.

If Income increases do I credit or debit the income account?

Credit

Income account balance increases so we credit the Income Account

Are Debits in the left or right column?

Left

Debit column is always on the left

Credit column is indexed in to the right.

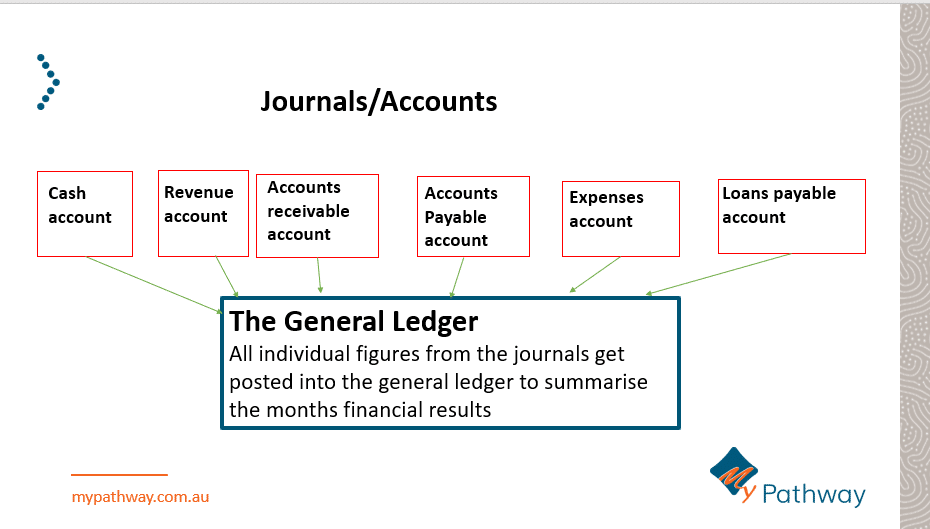

Task 2 -Post into General Ledger

Posting to the General Ledger is a straight transfer of figures directly from your Journal accounts into the General Ledger in their correct Debit and Credit Columns.

If using accounting software, this happens automatically.

Figure 7: All journal accounts are transferred to the General Ledger

Reconcile Discrepancies- The Trial Balance

Is a check sheet to make sure everything balances on your General Ledger before continuing with other reports.

A company prepares a trial balance periodically, usually at the end of every reporting period. The books are reconciled when the debits = the credits.

Task 3a- Trial Balance

Reconcile your accounts for the month by conducting a Trial Balance. Transfer figures from the General Ledger to the Trial Balance form into their correct Debit and Credit column.

Check that the Debit column equals the Credit Column. If it does, you balance.

Accounting Software to help

Check what software your accountant or bookkeeper recommends. Make sure it is compatible with what they use and complies with standard business reporting.

Xero, MYOB and Quickbooks are popular. Check them out, do a free trial and see which suits you best.

➡Review Knowledge Question 7

Once all journal entries have been transferred to the General Ledger, and the Trial Balance has balanced, you will then use these figures to produce financial statements that will indicate your financial performance for the month.

The 3 main statements you will use are:

- The Income Statement- (Cash+ Revenue – Expenses = Profit/ Loss)

- The Cashflow Statement – cash in versus cash out to test liquidity.

- The Balance Sheet – (Assets = Liability + Equity). Provides a snapshot of what the business owns and owes at a point in time.

Task 3b- Closing Entries

To “end the month” you need to transfer all temporary accounts like Revenue, Cash and Expenses to your Income Statement. This will determine whether you have made a profit or loss this month. Any profit or loss is moved to the Capital account. This process clears “the books” for the new month. All income and expenses start at zero again.

- Transfer all Revenue, Cash and Expense figures to the Income Summary (P&L statement)

- Determine if you have made a Profit or Loss for the month.

- Transfer Profit/Loss to the Capital Account in your Post-Closing Balance.

- Do not include Cash, Revenue and Expenses in your Post-Closing Balance. (They are now in the Capital account as a Profit or Loss)

Work through Task 3b

Task 3c- Post-Closing Trial Balance

This is your final trial balance to check that the books balance for the month.

- Transfer your profit/loss to the Closing Trial Balance under Capital account. A loss is debited and profit is credited.

- Transfer any other accounts still open to the correct credit or debit column on the Post-closing trial balance.

- Debits should equal Credits tobalance.

Post-closing trial balance is an accuracy check to verify that all debit balances equal all credit balances and net balance is zero.

Task 3d- Summary of any discrepancies and actions taken to rectify

- Have you entered all of your figures correctly?

- Have you entered them once in Debit and once in Credit?

- Have you entered them into the correct journal?

- Did you debit and credit correctly?

Explain any errors you found and how you changed it to make it balance.

The workshop recording walks you through Assessment 2 and explains the whole accounting process with examples.

Prior to submitting your assessment please work through the checklist.

News feed