Manage compliance for small businesses

About the Unit

Compliance essentially means sticking to the rules. It is your role as a business owner to have a system in place which ensures these laws, regulations and standards are followed in order to protect your investors, employees and the public.

Start here with the Study guide BSBESB405.

What’s the difference between an Act, regulations and standards?

Learning Outcomes

BSBESB405- Manage compliance for small business ventures

- Determine Compliance obligations

- Develop strategies to manage compliance requirements

- Implement & Monitor management strategies

- Conduct improvement in compliance management

Click on tabs for Learning Content

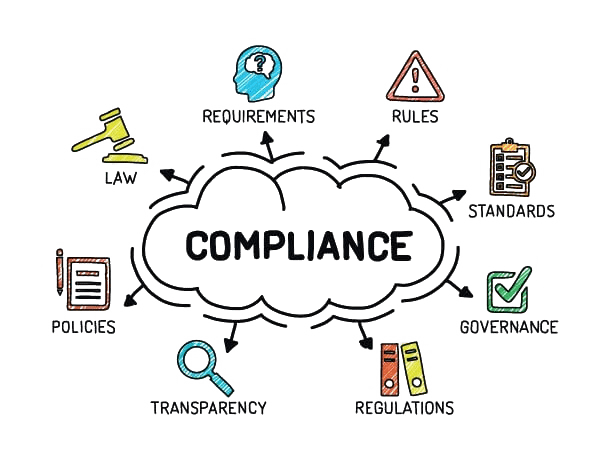

Compliance

“Compliance” is defined as “adhering to the requirements of laws, industry and organisational standards and codes, principles of good governance and accepted

community and ethical standards” (AS 3806-2006, Australian Standard: Compliance programs).

- Compliance standards are legally binding and enforced by government agencies.

- Failure to comply could result in fines, serious injury, death, business closure, imprisonment and loss of reputation.

Legal Essentials for Business

Every business has different laws and regulations they are required to follow.

As a business owner, it is your responsibility to know what these are and implement processes to ensure you comply.

These links below offer information on your legal obligations in business:

➡Review Knowledge Question 1 &

Assessment 2

- Watch the video at the top of the page on what is an Act, Regulation.

- Now you know the difference, you are required to research and find one example of each that is relevant to small businesses.

Refer to the links below to help you

Legislation- just a few examples plus the links above.

➡Review Knowledge Question 2

Specialists who can help

Know where you can get help. There are many specialists who offer services and advice to ensure you remain compliant in business.

Some government agencies offer free advice. The Australian Taxation Office, Fairwork Australia and Worksafe Australia are three examples of organisations that offer educational support and templates you can use to keep your business compliant.

There are other professionals who can give helpful advice at all stages of the business cycle.

*** It is important to note when choosing a specialist, check their qualifications and licenses match your needs. e.g. some bookkeepers are not qualified to help you with tax.

Only choose reputable companies or government organisations you can trust.****

Workplace Health & Safety

Legislation is Federal, however, each state is responsible. Check out your states WHS website.

This is an example of one of the many available videos that Worksafe produce in every state of Australia.

➡Review Knowledge Question 3 &5

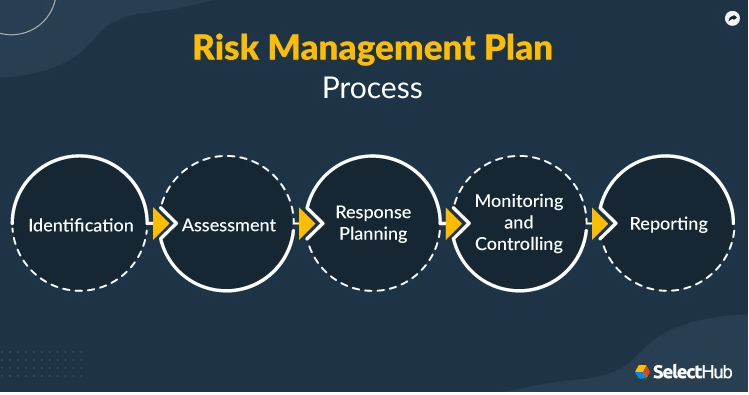

Compliance is Risk Management and follows a similar process

➡Review Assessment 2 Projects

Compliance Management Strategy/ Framework

A Compliance Management Strategy is how your business intends to remain compliant and obey the laws, rules and regulations by using its Compliance Management Framework.

The Compliance Management Framework aims to create an integrated, strategic and consistent approach to managing compliance obligations.

Similar to your Risk Management cycle, compliance is about reducing or eliminating the risk of breaking the law or ethics.

The similar steps apply in a Compliance Management Strategy/Framework that apply to your Risk Management Plan.

- Identify the risk- determine what your compliance obligations are.

- Assess the risk- use your risk matrix to determine the likelihood versus the consequences of each legal requirement.Decide what steps are required for you to implement.

- Control/Eliminate those risks- design policies, procedures and processes based on these.

- Communicate- delegate responsibilities, accountabilities and train all stakeholders.

- Culture- build a “safety first” team culture to ensure compliance.

- Review your controls- conduct audits, gain feedback, monitor results.

- Report- show due diligence by having written reports investigating any breaches and the corrective actions taken to rectify these.

➡Review Assessment 2- Project 2

This video below explains how to assess your risk by using the risk matrix tool.

The Four Components to include in the Compliance Framework include:

- Strategy and Objectives- Explain what your business’s approach and commitment is to managing compliance and risk .

- Policy and Procedures- Create policies that align with your business objectives. Develop tools and procedures that are embedded into your business processes to ensure they are easy to practice.

- Resources and People- Allocate resources effectively to develop, maintain and improve your compliance program. This includes developing an organisational structure outlining communication channels, responsibilities and accountabilities. Ensure regular training and meetings to encourage open communication.

- Culture- create and support a culture of compliance to encourage an innovative, safety conscious cohort. Lead by example from the top down.

➡Review Assessment 2- Project 2

How to use the risk matrix to determine if the risk is low, medium or high

➡Review Question 4 & 6

& Assessment 2 Projects

Methods to check compliance

Rules and regulations change, people get busy and fail to follow procedures or we feel we don’t have time to follow them. Procedures and processes are only effective if they are followed. To remain vigilant about compliance there needs to be checks along the way to make sure it is happening and your business is protected.

As with all legalities, due diligence needs to be shown. Due diligence is “the reasonable steps taken by a person to avoid committing an offence.”

It is your responsibility as the business owner to prove all reasonable actions have been taken to prevent committing an offence. This information needs to be well-organised and easily found, if you are ever audited. Government departments like The Australian Tax office, Workcover , Liquor Licensing, Food Safety conduct regular audits of businesses.

So we need to consider what checks and measures you will implement for each stage of your compliance management strategy.

You have written your strategy and implemented it. How do you check that everyone is following the rules?

Identifying legal obligations: How do you stay current?

- set up email notifications from government departments for any changes to rules and regulations.

- set up reminders to check on updates

- join industry groups online who can update you

Assessing, controlling and communicating

- schedule regular risk assessment checks

- any new changes need to have risk assessments conducted immediately, documented and filed.

- conduct daily, weekly, monthly spot checks on paperwork.

- observe, retrain and document training and performance management discussions.

- Point of Sale (POS) reports printed to check transactions and correct processes are being followed.

- implement a training and induction register, file

- file all communication, emails etc. about compliance.

- create and file all minutes from meetings.

- implement audit checklists

- gain feedback from staff in writing, document actions implemented to improve and file.

- implement incident and near miss forms

- create a WHS team responsible

- implement an organisational chart that outlines responsibilities and communication channels.

Monitoring, Reviewing and Reporting.

- schedule regular monthly audits

- schedule tax reporting checks

- schedule meetings, discuss incident and accident reports, sick leave, worker compensation claims, breaches of procedures.

- review training register

- review feedback from staff

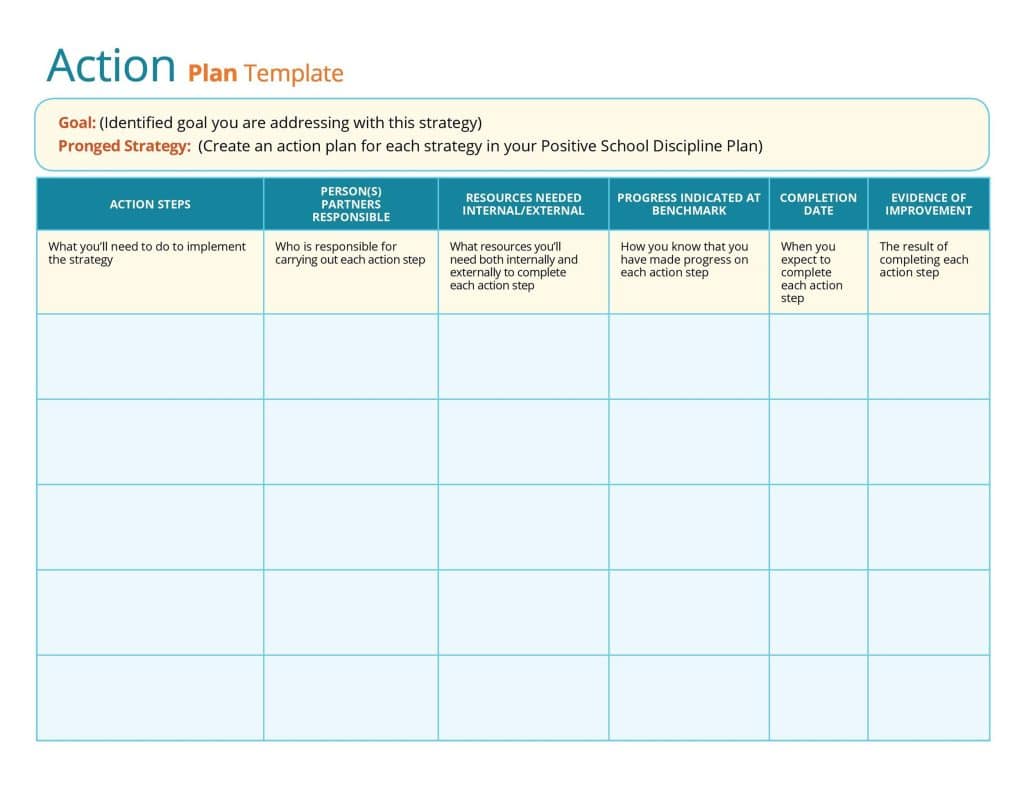

- design an action plan, delegate duties and time for completion.

- file all documentation.

➡Review Knowledge Question 6 &

Assessment 2 Projects

Workplace procedures for:

Accessing expertise- what are the risks to consider when accessing specialist services? You need to check they are registered and licensed for what you need them for.

You also need to determine when you will require their services . How often? and whose responsibility it is to engage them? Consider these points when writing your procedure.

Checking your compliance obligations- how do you check your business is following its policies and procedures and remaining compliant?(Q4 can help)

Allocating responsibilities- refer to Q4- what procedure will you implement to make sure everyone knows who is responsible for what and who they need to communicate to?

Recording audit results and when they are conducted- again refer to Q4- how will you record when you completed your audits and what the results were?

Business policies, processes, procedures and codes of practice.

Business Policies, processes, procedures and codes of practice can help you to:

- Minimise risk

- train your employees better

- comply with legislative and regulatory obligations

- improve your business operational efficiencies

- manage staff and customer expectations better

- work effectively with suppliers

Policies often link to the regulations. They are the why.

Procedures are the how you will implement the policy into your workplace. The procedure is a set of instructions on how you and your team will perform tasks so that they will meet the legislation and ensure you remain compliant.

This is a process that your team are expected to follow. Failure to follow policies and procedures could result in your business being adversely affected. You could be fined, lose your reputation, hurt someone or even be imprisoned.

This is why it is imperative to have processes in place to check that all policies and procedures are being followed. You might conduct regular audits or training sessions or do random spot checks. A well organised and documented process is beneficial as proof if you are ever audited.

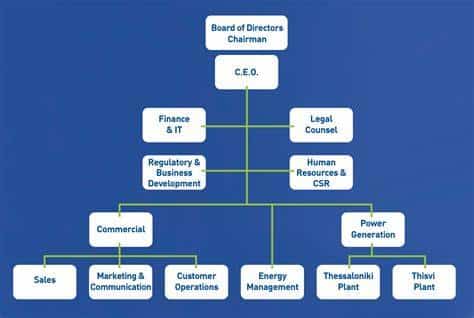

Communication of compliance

In businesses that have many staff, communication is key to ensuring that compliance is met. Clear responsibilities and communication channels are required. An organisational chart is a tool that will help communicate this. It is a diagram that clearly indicates the hierarchy and who is responsible for what and the channels that should be followed when communicating. An example of an organisational structure is below:

This example of an organisational chart indicates the hierarchy of responsibility. At the top is the CEO leading down through the Management tiers and finishing with the operations.

The green lines indicate the communication channels. In this diagram the CEO communicates directly with Finance, Legal, HR, Regulatory & Business Development, Commercial and Power generation.

Finance and Legal work together on the same level any issues they go to the CEO.

HR and Business Development work together any issues they go to the CEO.

Sales, Marketing and Customer operations speak to the Commercial Manager. The Commercial Manager then takes it to the upper management or CEO.

Energy Management takes it to Commercial or Power generation and then they take it to the upper management or CEO.

This chart indicates the different areas of the business and how departments should work together.

The Commercial department which is responsible for bringing in revenue, is responsible for sales, marketing and customer service. All three departments work together to achieve their commercial goals.

Allocating Responsibility

To ensure a positive culture of compliance, it is beneficial to include those who are required to perform the tasks in the decision making process. If they feel empowered, then they will follow the procedures.

For example, if we look at the organisational chart above you would allocate the following responsibilities:

Taxation Legislation – Finance

Marketing Legislation- Regulatory and Business Development

Industrial Relations- Human Resources department

Licenses and registration- Legal Department

These departments would be responsible for creating policies and procedures. These then get communicated to the Department Managers who are responsible for training, implementing, monitoring and reviewing compliance records.

Ultimately, the CEO is responsible for company compliance. They would also conduct regular audits throughout the year or even hire an external independent auditor to check occasionally.

Conduct Improvements to Compliance Management System

There are 5 steps to the improvement process when reviewing your compliance framework.

1. Review

- Conduct audits and review your processes.

- Ask your staff what works and what doesn’t. Do they have any suggestions?

- Check all incident and accident reports.

- Check all training records, feedback forms.

2. Analyse results

- Identify non-compliance issues

- what areas of improvement do you need to implement?

- create an action plan – task to be completed, by whom, by when.

3. Update documentation

- update policies and procedures including version numbers

4. Communicate

- conduct training sessions

- conduct meetings

- send emails and notifications communicating changes

5. Report Improvements

- document and file all changes

Compliance Audits

Compliance audits are essential for businesses to ensure that they meet legal requirements or that they are working towards getting aligned with set parameters. Regular compliance audits help organizations achieve the following:

- Ensure a safe working environment – comply with government requirements and safety protocols intended to promote a secure and stress-free workspace

- Increase productivity – manage production downtime and boost profitability

- Prevent penalties – stay compliant with legal standards to avoid any legal issues and consequences

- Establish a good reputation – gain public trust and dominate the industry you belong to by staying aligned with industry protocols

- Continuous operation – non-compliance with regulations can lead to disruption or even operation cessation

Conducting audits

When conducting audits you need to have a process or procedure in place that stipulates:

- how often these will be conducted.

- who will be responsible for conducting them.

- what is the reporting procedure for non-compliance.

- where are the completed documents filed.

- what is the process for improvements.

- who is to receive a copy of the audits.

- it is also wise to set calendar reminders, so they don’t get missed.

- do the occasional spot check to make sure they are being conducted to the standard you require.

A Strategy is your plan on how you will reach the required objective.

In the case of Project 1- How will you meet your responsibilities and legal obligations for the mentioned legislation?

Processes are the way the task is to be carried out. It focuses on the steps you will follow or the actions you will take to meet your strategy. (procedures)

Monitor is the process of reviewing the actions taken. Have they been effective and achieved what you wanted to achieve?

example: Australian Consumer Law.

Business obligation: cannot make any false misrepresentations about product.

My strategy is to have a Communications Policy in place to control messages about my product.

My process is –

- design and implement a communications policy and procedures for all forms of communication, digital, verbal and written.

- train all new staff on these procedures

- develop and communicate an organisational structure outlining the chain of command.

To monitor this strategy –

- I will obtain regular feedback from customers, suppliers and other stakeholders.

- Regularly review any changes based on KPI’s.

Investigating non-compliance and taking corrective action

When it becomes apparent that non-compliance has occurred, you need to investigate how and why this has happened. It will highlight that your current risk management plan has not mitigated your risk effectively and you may need to implement some corrective actions to prevent it from happening again.

You may fail to pay a tax bill on time and the Taxation Department contact you threatening you with a fine due to non-compliance.

Step 1: Investigate

a) are their claims true and accurate based on your research?

b) how did you fail to pay this bill on time?

c) what are your current processes that you follow?

d) what is the identified gap that has allowed this payment to be missed?

Step 2: Corrective Actions

a) Now you have identified why this happened, what steps will you implement to prevent this from happening again?

The Action Plan

An Action Plan documents the identified non-compliance and the actions your business will take to rectify the problem. It provides information on who is responsible and when the problem will be fixed. This is a great document to keep people accountable and provides evidence to auditors that you are proactively managing your compliance.

A Strategy is your plan on how you will reach the required objective. In the case of Project 1- How will you meet your responsibilities and legal obligations for the mentioned legislation?

Processes are the way the task is to be carried out. It focuses on the steps you will follow or the actions you will take to meet your strategy. (procedures)

Monitor is the process of reviewing the actions taken. Have they been effective and achieved what you wanted to achieve?

example: Australian Consumer Law.

Business obligation: cannot make any false misrepresentations about product.

My strategy is to have a Communications Policy in place to control messages about my product.

My process is –

- design and implement a communications policy and procedures for all forms of communication, digital, verbal and written.

- train all new staff on these procedures

- develop and communicate an organisational structure outlining the chain of command.

To monitor this strategy –

- I will obtain regular feedback from customers, suppliers and other stakeholders.

- Regularly review any changes based on KPI’s.

Document 4- Assessment 3- Business Plan Instructions

- Write your full name on the top of the first page “Participant name:”

- Attach a completed copy of your Operational Plan to be marked.

- Attach the completed parts of your Financial Plan that are requested.

Check off the Assessment Submission Checklist

This will ensure you have completed all tasks and paperwork correctly and we won’t need to return anything before marking.

News feed