Plan finances for new business ventures

About the Unit

This unit provides you with the knowledge of how to prepare and develop a financial plan for your new business and how to acquire finance to support your business as it grows.

Start with the Study guide BSBESB403.

How do I project business financials for a new business venture?

Learning Outcomes

BSBESB403- Plan Finances for new business ventures.

- Prepare to plan finances for new business venture

- Develop a financial plan

- Plan to acquire finances

Click tabs for Learning Content

Processes used to Calculate Business Costs.

Knowing your start-up costs and creating a realistic budget from the beginning will set you up for success.

These links will explain how to identify your costs when starting a business:

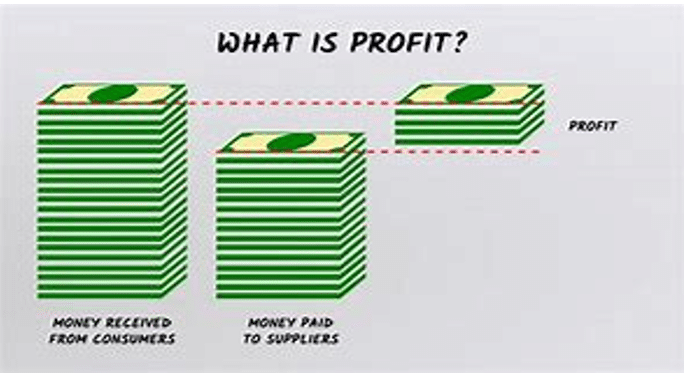

Costs and Profit

Every business owner starts a business planning to make a profit. Profit is the money leftover once you have paid all of your bills.

There are many types of costs and expenses associated with business:

- Fixed Costs and Variable costs. Fixed costs do not change with business demand. e.g. rent. Variable costs – do change depending on business demand e.g. stationary needs.

- Establishment or Start-up costs are your one off costs you spent before business operations began.

- Fixed Assets or Non-Current Assets (Property, Plant & Equipment) are vital to make your business happen.

A successful business relies on being able to make a profit. For both product and service-based companies, the cost per unit is a valuable calculation to ensure their costs are lower than what a unit sells for. Owners, managers and analysts work on adjusting the cost per unit to meet sales goals.

Average cost of production refers to the per-unit cost incurred by a business to produce a product or offer a service. Production costs may include things such as labor, raw materials, or consumable supplies. In economics, the cost of production is defined as the expenditures incurred to obtain the factors of production such as labor, land, and capital, that are needed in the production process of a product.

Setting your profit target

Money received from Consumers minus money paid to Suppliers = Profit

Profit margin is a common measure of the degree to which a company or a particular business activity makes money. Expressed as a percentage, it represents the portion of a company’s sales revenue that it gets to keep as a profit, after subtracting all of its costs.

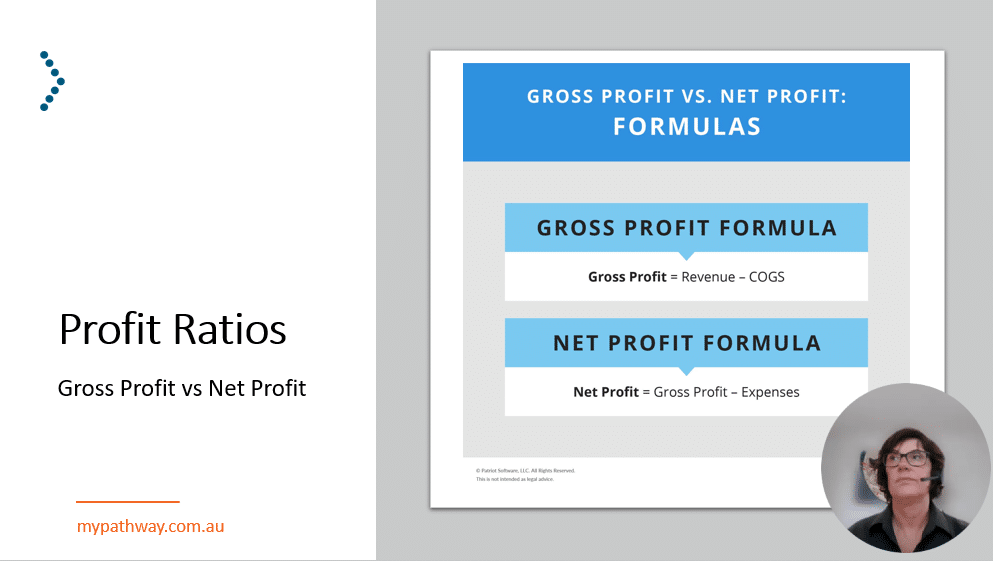

The two formulas below show you how to calculate your net and gross profit.

➡Review Knowledge Question 1

Contribution Margin, Break-even and how your pricing helps.

In order to make a profit, we need to keep our costs down and our sales high.

How much profit should you aim for? What is my Profit Target?

There are many factors that will affect your decision on this. You may choose to have a profit margin which is a % figure, or you may have different mark- up rates based on what people are prepared to pay or what your competitors are charging.

The Break-even point is when your business is not making a profit or a loss. All of your costs = your expenses. Once you reach your Break-even point you can start to make a profit. 🎉👍🎉 The higher the price you charge, the more profit you make and the quicker you will reach your Break-even point. Sounds easy right?

However, what if the price you charge is too high and no-one buys your product? Or worse, your price is too low, so customers don’t trust its quality so they don’t buy. The pricing strategy you choose will determine how your customers perceive your product, how much you sell and how much profit you make. It is crucial to get your pricing strategy and tactics right.

Price your goods with the right margin or mark-up.

➡Review Knowledge Question 1

Please watch these videos to learn more:

➡️Review Knowledge Question 5

➡Review Assessment 2-Task 2

Formula Summaries:

- Unit Contribution Margin = Unit Sales Price – Total Variable costs per unit/ Unit sales price

- No. of units to Breakeven = Fixed Costs per unit/ Contribution Margin

- Breakeven sales point = No of units to breakeven X $unit price = $sales required to break-even.

***Try this Break-even calculator. Put your figures in and see what your Contribution Margin is, what your breakeven point is and how many units you need to sell. ***

It is so easy!!

Download the document to your computer so you can use it.

Do you know the answer?

What are fixed costs?

Costs do not change with business demand

Start up costs can also be one off

Place your mouse over the box to find out if you’re correct.

What is Breakeven point?

Revenue = Expenses, no profit.

When all expenses are paid with revenue earned. Once you reach breakeven you can start to make a profit.

Did you get all three correct?

What are variable costs?

Costs that change with demand

If business demand increases, then you need to order more stock so your variable costs increase.

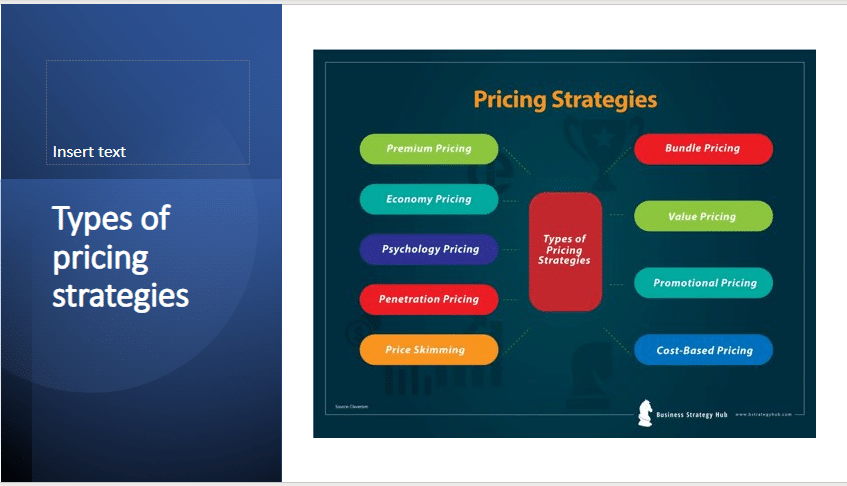

Please watch this video on the different pricing strategies you could consider for your business:

Pricing Strategies

A pricing strategy is the approach your business takes to price your products or services. The goal of your pricing strategy is to maximise sales and profits, outperform competitors and best serve your customers.

Common pricing strategies

Businesses usually set their prices based on the following pricing strategies:

- the cost to provide your goods or service plus a percentage

- what the customer is prepared to pay

- the demand and life of your product

- what your competition charges

What are the 8 Pricing strategies?

- Cost plus pricing

- Competitive pricing

- Price Skimming

- Penetration Pricing

- Anchor Pricing

- Value-based pricing

- Bundle pricing

- Loss leader pricing

➡Review Knowledge Question 2 & 3.

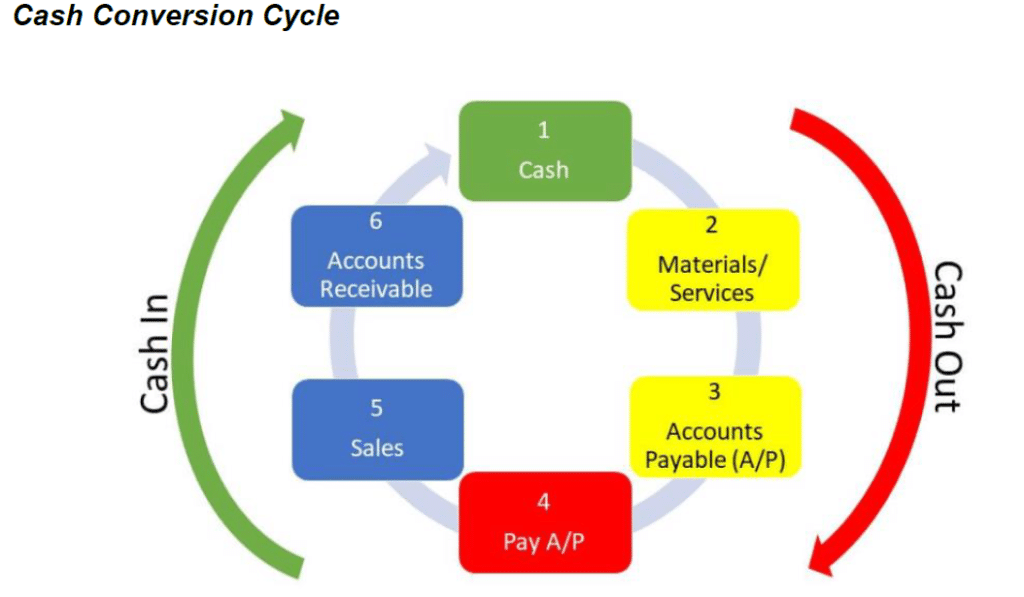

Working Capital and The Working Capital Cycle

The Working Capital Cycle (WCC) or Cash Conversion cycle, is a measurement of how long it takes for a business to turn their cash from the bank into cash from the customers. Ideally, you want to collect your money quickly and pay your bills slowly to keep cash in the business and help cashflow.

This diagram shows the cycle of cash out from the bank to purchase goods and bill customers to the time this cash is converted to payments received, and sales.

“Understanding the cash conversion cycle and how you can make it work for your business can help increase efficiency and cash flow. Credit terms specify when payment is due on sales made to customers on credit. ”

(Ezy-Learn, Steve Slisar,2022)

This can be measured by using the working capital cycle formula.

Click on the link below:

Cashflow forecasting and statement

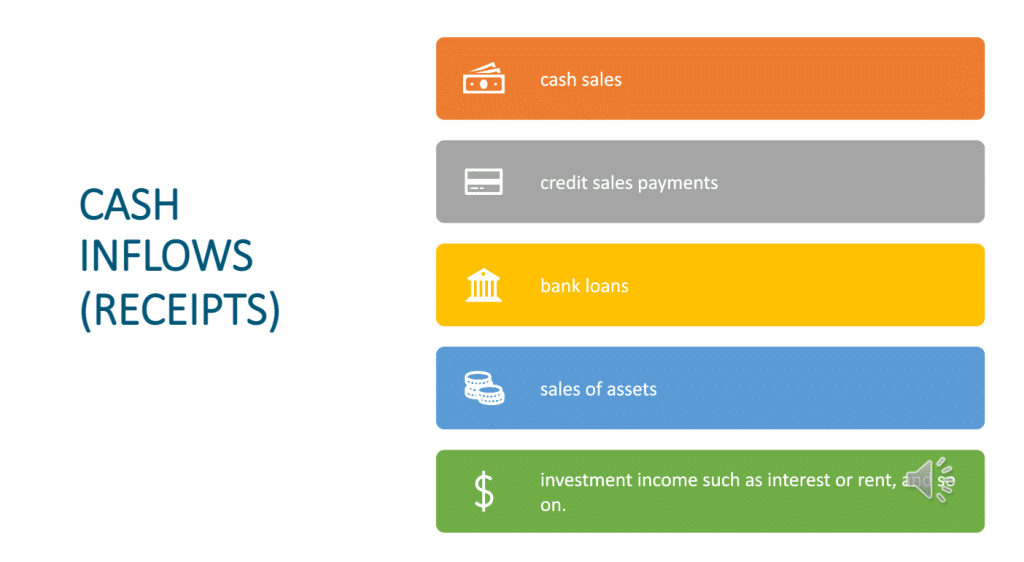

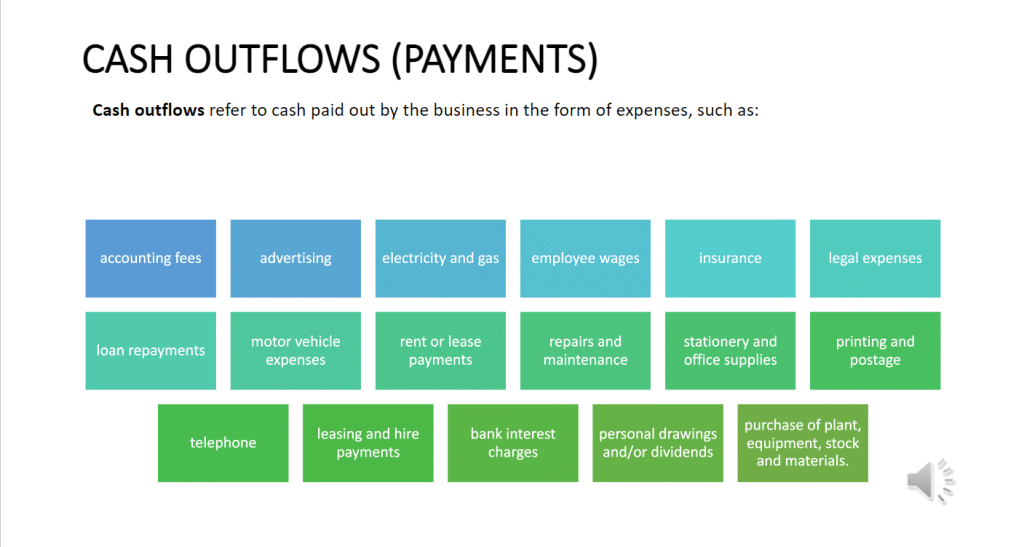

Cash Flow is cash or revenue coming in versus the cash or expenses going out. It can be tricky at times, depending on the business you have. It is an indication of your liquidity or ability to pay your bills on time. Many businesses are profitable but can run out of cash.

Some businesses may have peak periods they need to plan ahead for. This is when Cashflow forecasting is useful. Forecasting is predicting the future by making educated guesses about your business. For example, a business may have demand peaks at Christmas. They need to purchase stock in October ready for their busy December. However, October is a quiet month with minimum cash coming in.

The Cashflow Forecast will help them identify this need early, so they can arrange funds now to ensure stock to sell for Christmas.

A Cashflow Statement, like your bank statement, is the past. It is a document you use to review and analyse your current ability to pay your suppliers on time.

As you build more history, you will use these reports to develop forecasts for the coming years ahead. Maintaining good records will help your forecasting become more accurate and help you achieve your goals and objectives.

“Cashflow for Small Business” is a 30-minute training session from the ATO (Australian Taxation Office). To fully understand how to manage the liquidity of your business, click on the button below:

Financial Reports for Business

Why do we need Financial Reports?

- There are legal and statutory requirements that require you to keep certain financial records for a number of years. (refer to the ATO)

- They are a useful tool to monitor your business performance

- Reports can be used to apply for finance.

- Reports can be used if you want to sell your business.

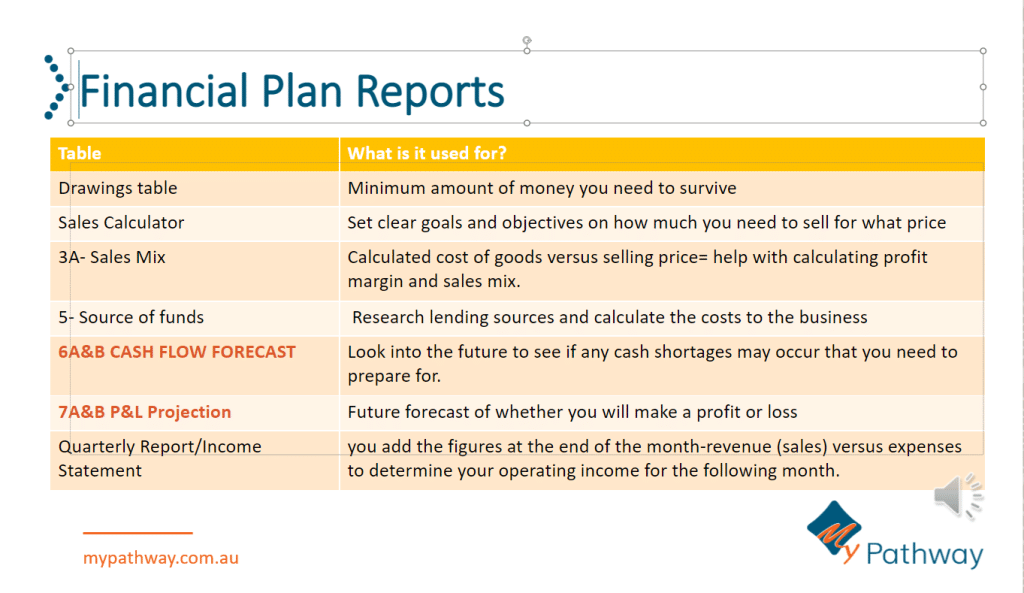

You will refer to your Financial plan often and use the many reports to monitor your progress and identify if you need extra finance to get you through.

Two common reports are the Profit & Loss Statement/ Profit and Loss Forecast and the Balance Sheet.

The Profit and Loss Statement is stating how your business is tracking using past figures, the Profit & Loss Forecast is predicting the future.

The purpose of the Balance Sheet is to give you an idea of your businesses net assets at a point in time. On a particular day, this is your balance. This highlights your liquidity or how much cash you have available to pay the bills and your working capital requirements. The links below explain this further.

Preparing Financial documents

Refer to your completed Financial Plan and see how you prepared your Cashflow forecast and Profit and loss Forecast.

Below are two links explaining how to prepare a Balance Sheet and a Profit & Loss Statement.

➡Review Knowledge Question 6

➡Review Assessment 2- Task 6

“Explain the steps required to prepare a Balance Sheet, Cashflow Forecast and Profit and Loss Statement.”

Sourcing Finance- financial support for your business.

You may throughout your business journey require financial assistance at some point. It is wise to have a contingency plan that you can implement quickly to reduce your risks of failing liquidity or lack of cash.

There are many choices available for sourcing finance.

Refer to the links below and research your options.

➡Review Assessment 2- Task 5.

- Complete the table by researching three different financial sources. What are their fees, terms and conditions?

- Provide the references that you used to find this information.

- Also investigate the process you are required to follow to apply for the finance.

Task 3- Monitoring Financial Performance

Your Financial Plan consists of numerous reports. These include your Sales mix, Cash flow forecast and Profit & Loss Forecast. These forecasts are what you have estimated will happen to your business in the future.

Now that the new business venture has started, those forecasted figures need to be measured against the actual sales and costs. Is the business exceeding, meeting or under performing against the forecast figures? If not, why not? What changes and actions need to be implemented to improve results?

Setting Key Performance Indicators (KPI’s) will assist you in measuring your success. Some examples include number of items sold per ticket, average spend per ticket, profit margin, contribution margin, conversion rate, return on investment.

Taxation obligations will also require thorough record keeping and time management procedures to ensure all legislation and taxation responsibilities are met.

Financial Information to be monitored.

When monitoring your performance there is a wide choice of financial information available to review, depending on what you are measuring. You could refer to the examples below that indicate the money coming in and going out of your business. What is the sales revenue versus the cost of goods? This will indicate your profit levels. You could also check you assets versus your liabilities.

Financial documents to review

This financial information can be sourced from a number of financial documents. This can include bank statements, invoices, purchase orders and receipts. You may compare results achieved with your Cashflow or Profit & Loss forecast or sales projections from your financial plan.

Key Performance Indicators (KPI’s) and evaluating your performance

A KPI is a measure an organisation uses to gauge performance against an objective in a specified time. Once you know where you want to go with your objectives, the KPI’s will measure the key points you need to reach to achieve your goal.

For example- your business objective is to make $70 000 in 12 months in sales turnover. Your KPI’s to achieve this goal might be to make $5900 a month in revenue or sell an average of 60 items a month. These KPI’s are the small indicators that help you achieve your big goal.

There are different metrics you can use to measure. If your marketing strategy is Cost Leadership then your KPI metrics could be market share, cost per unit or volume. If it is a Differentiation strategy then you may choose quality, customer responsiveness or customer service KPI’s.

If operational strategy is based on process your KPI’s might be based on Cost of goods, production times, WCC, profitability.

This video below explains the importance of KPI’s, because “WHAT GETS MEASURED GETS DONE.”

Actions to prevent financial concerns including tax.

Fixed Asset Management

A Fixed asset or Non- current asset is an item owned by the business which cannot be turned into cash within 12 months. It can include Property, Plant and Equipment used in the ongoing business.

When managing fixed assets, preventative maintenance schedules and depreciation should be considered to ensure you get the most out of these assets.

Always gain advice from your accountant on any large decisions. There is software available that can help you with this as well.

It is important to protect your assets and keep them maintained. Scheduling regular services, keeping the preventative maintenance schedule up to date, consulting your accountant about depreciation every year or capitalising on a long term asset will make it worth your while.

➡Review Assessment 2- Task 4.

Document 4- Assessment 3- Business Plan Instructions

- Write your full name on the top of the first page “Participant name:”

- Attach a completed copy of your Operational Plan to be marked.

- Attach the completed parts of your Financial Plan that are requested.

Check off the Assessment Submission Checklist

This will ensure you have completed all tasks and paperwork correctly and we won’t need to return anything before marking.

News feed