Research and develop business plans

About the Unit

Fail to Plan, Plan to Fail!

Learn why you should have a business plan and how to prepare and develop one for your business. Identify legal requirements, establish risk management procedures and develop an understanding of the elements required when planning a business, big or small.

Start with our Study guide BSBESB401

Why do I need a Business Plan?

Learning Outcomes

BSBESB401 – Research and develop Business Plans

- Identify the purpose and uses of a Small Business Plan.

- List the required components of a Small Business Plan.

- Conduct and analyse valid, current and reliable research for each component of the business plan.

- Develop strategies for controlling risk, marketing, operations and financials.

- Write a business plan that includes research results, strategies and forecasts to help meet the business objectives.

Click on Tabs for Learning Content

Introduction

Business Planning is critically important to a new business venture. It sets you up for success and helps your business adapt and grow.

The purpose of the business plan is to:

- Formalise your business ideas.

- Set goals and monitor progress.

- Assist you to apply for a loan or raise business capital.

- Keep you focused.

➡Review Knowledge Question 1

Click here to learn more:

Why do I need a Business Plan?

- Helps clarify business ideas

- Proves the feasibility of the business

- Identifies goals and objectives

- Gives a clear road map of direction

- Addresses all issues that may be encountered before entering the market

- provides benchmarks to measure against

- gives confidence to succeed in business

- can help sell your business or raise Capital

Q: Who is my audience? Who do I share my Business plan with?

A: Your Key Stakeholders

A “stakeholder” is anyone that has a significant influence or interest in your business.

The Key Stakeholders in the Business Planning process could be;

- a business partner

- a shareholder

- an investor

- a bank manager

Customers are also stakeholders because their feedback influences your business decisions. However, you would not share your Business Plan with them. There is too much confidential information about financials and operations in your Business plan to share with them.

➡Refer to Knowledge Question 2

Factors to consider before you start your Business plan

➡Review Knowledge Question 4

Where am I now?

- what’s my business idea?

- what could be my niche?

- who could my customers be?

Where do I want to be?

- Set your goals about what you want to achieve personally and professionally. If these two don’t align, you will unlikely stay motivated and driven to succeed.

How do I get there?

- Create an action plan

- Outline the steps required to achieve your goals.

- Set times to achieve these

- Delegate who is responsible

- Plan to monitor and review regularly.

The Preparation Process before you draft your Business Plan.

Before commencing your business plan, there are a number of activities you need to conduct. These include:

- Forecasting or estimating current and future events is vital for the success of your business. These forecasts provide a framework for your business plan and will be reviewed constantly throughout your business journey.

- Setting goals and objectives establishes the outcomes you want to achieve in your business. Firstly, you set your big picture goals and secondly you write your objectives which are the small, measurable steps you take to achieve these goals. These goals and objectives are all based around your forecasts.

- Formulating policies will occur in every step of the business plan. These guidelines will govern the way your business handles current and future problems. Policies will need to be considered for areas such as payment terms, suppliers, returns and so on.

- Programming & Scheduling: establishing what needs to be done by when to achieve your objectives. Managing your time and resources to achieve maximum results.

- Budgeting: arranging your finances to meet your goals and objectives. All areas of finance will need to be considered to ensure the success of your business.

- Developing Procedures governs the way you and your people perform tasks in the business. They are the rules or guidelines that determine the behaviour of the people and require careful consideration at every stage of the business planning process. Workplace procedures can include cash handling, stock control or security measure procedures.

➡Review Knowledge Question 3

Objectives need to be SMART-

this video explains what SMART stands for. (Although they call them “goals”, in business planning they are “objectives”.)

➡Review Knowledge Question 5a &b.

Researching Information for your Business Plan

Conduct Research:

Primary & Secondary Research

There are a number of different methods you can use to research or collect data. Primary Research methods are first -hand information you receive from the source. It may be through surveys, interviews, observation or personal experience.

Secondary Research is “desk research”. It is information available to the public. It may be internet research, reading reports, watching youtube videos etc.

Direct methods of data collection involve collecting new data for a specific study. This type of data is known as primary data.

Indirect methods of data collection involve sourcing and accessing existing data that were not originally collected for the purpose of the study. This type of data is known as secondary data.

SWOT Analysis

A SWOT analysis is a tool you can use for many parts of your business. It helps you determine your strengths and weaknesses(internal) and the opportunities and threats (external).

You could do a self awareness SWOT analysis to determine what areas of the business you need support in. You could also use it for the business itself compared to your competitors.

Click on this link to learn more:

➡Review Knowledge Question 9

This diagram shows that your aim is to transform your weaknesses to strengths and the threats to opportunities.

You want your strengths to be your opportunities.

You want to remove weaknesses and threats. (if possible)

1.Identify your customers

- What are their needs, wants and demands?

- How much are they willing to pay?

- How do they prefer to shop?

- How often do they shop?

- How much product will they buy?

Goals vs Objectives

In business, Goals are “Big Picture”.

Steve Jobs stated that Apple’s goal was to:

“make the best personal computers in the world, that we can be proud to sell at the lowest possible price.”

This statement is generalised and intangible but gives a clear direction for any decisions to be made for the business from the boss down.

Objectives are the small, measurable steps you take to reach your goal.

An example of possible objectives for the goal above using the SMART method could be:

“Apple will have 50% market share in personal computer sales by December 2024.”

Watch this video to learn how to write SMART objectives

➡Review Question 5a & 5b

Know your Goals and Objectives.

The benefits of setting business goals:

- help you stay focused and motivated.

- help you strategise effectively.

- measure your progress.

- provide clarity and direction to all involved.

- provide evidence to an investor of your performance.

Risk Management

A risk is the chance of something happening that will impact your business. These risks can be internal risks such as staffing issues or external risks such as natural disasters.

A Risk Management Plan will minimise the impact of unexpected incidents and help your business recover quickly.

What is an internal risk?

Response:

An internal risk is something you, as the business owner can control the outcome.

Examples include:

- staffing issues

- cashflow issues

- production issues

What is an external risk?

Response:

Any risk that is out of your immediate control.

Examples include:

- economic downturns

- natural disasters

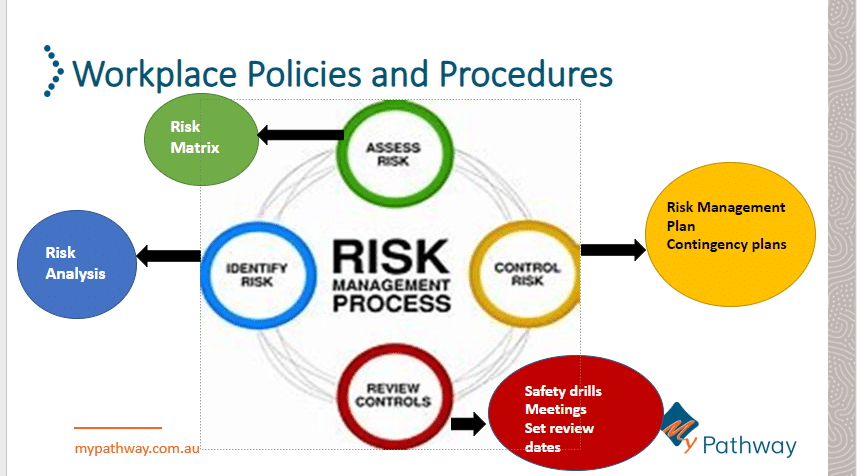

The Risk Management Process

The 4 steps

-

Identify the Risk

-

Assess the risk

-

Control or Eliminate the Risk

-

Review the Controls

1.Identify

How many hazards can you identify?

A hazard is anything with the potential to cause harm. When identifying risks, you need to conduct a hazard analysis. What are the possible risks? What is the likelihood of it happening and how serious are the consequences to the business if it were to occur?

Activity-

Click on the link below and choose your own adventure! See how many hazards you can find.

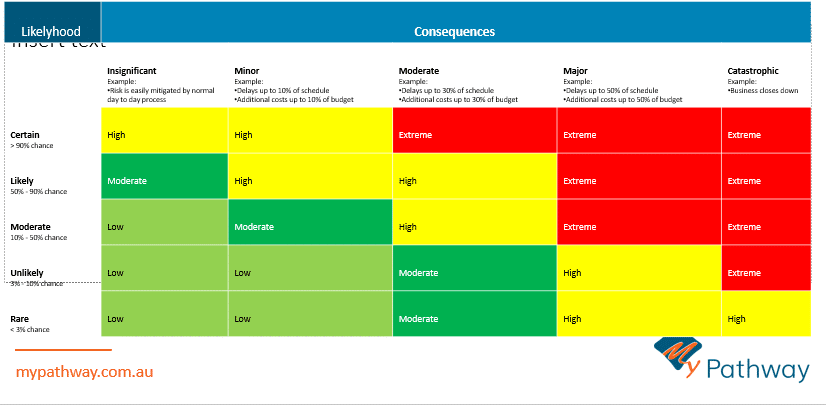

2. Assess the Risk

Use a Risk Matrix

Now the risks have been identified, let’s assess the risk. What is the likelihood it could happen and what are the consequences to your business, if it does happen?

Using a Risk Matrix is an effective tool for assessing risk levels and determining your priorities.

Watch this video to learn how to use the Risk Matrix

3. Control the risk

You have established which risks are low, medium or high. Now you need to prioritise these, put controls in place to minimise, or ideally, eliminate them.

The “Hierarchy of Controls” explains the different types of controls you can implement in order of their effectiveness. At the very top of the pyramid, eliminating the risk is the best result you want. However, sometimes this is not feasibly possible, so you need to explore other options. The last resort is Personal Protective Equipment (PPE). This should only be used to supplement other solutions as an extra precaution, NOT the only solution.

This video explains the different levels to control risks and hazards.

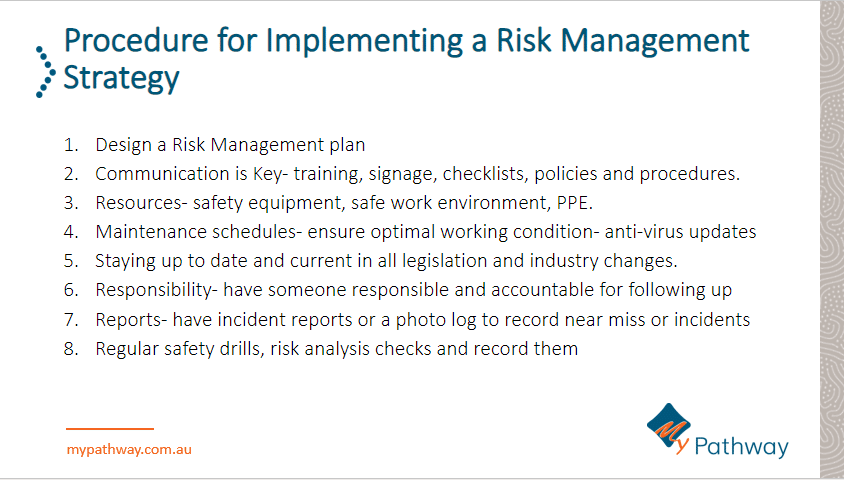

Policies and Procedures

Policies are the WHY you do it. (usually there is a risk or legislation you need to comply with)

Procedures are the HOW you do it. (a description of the steps you and your staff will follow to reduce the risk or to remain compliant)

Your business needs to design a number of different policies and procedures to reduce the risk of breaking the law and ensure consistency and quality of service for your customers.

The link below gives advice on procedures. There are more links at the bottom of the page.

➡ Review Knowledge Question 10

4. Review and Monitor Controls

Putting controls in place and not monitoring them can put your business at risk. Risks and their priority can change. It is important to have the processes in place to deal with changes promptly to ensure the controls are adequate and your insurance is up to date.

- Set a schedule to revisit your risk management plan.

- Monitor your incident reports and speak regularly to those affected, gain feedback and input from them.

- Review customer feedback to check performance.

- Conduct regular cash flow checks.

- Sign up to newsletters to stay informed and up to date.

- Join networking business groups.

- Keep your insurance up to date.

➡Review Knowledge Question 6 & 10

Prevent and Prepare ➡ Respond ➡ Recover ➡ Communicate

The Risk Management Plan

Unexpected events can happen at any time. Be prepared, so you can get up and running again as quickly as possible.

The Risk Management Plan allows you to understand the potential risks and identify ways to minimise these or recover from their effects. The strategies you develop in your Risk Management Plan should link to your Business Plan objectives.

A Risk Management Plan includes:

- a detailed list of all internal and external risks.

- an assessment of the impact on the business in relation to each risk

- actions to be taken if risk was to occur

- time frames for the treatment of each risk

- a list of key people and their responsibilities

- an indication of how progress will be monitored

Make sure you have the resources available to implement the plan.

➡Review Business Study Task 1a- refer to your business plan to identify the possible risks

Click on the link below. It provides a comprehensive checklist you could use to develop your Risk Management Plan.

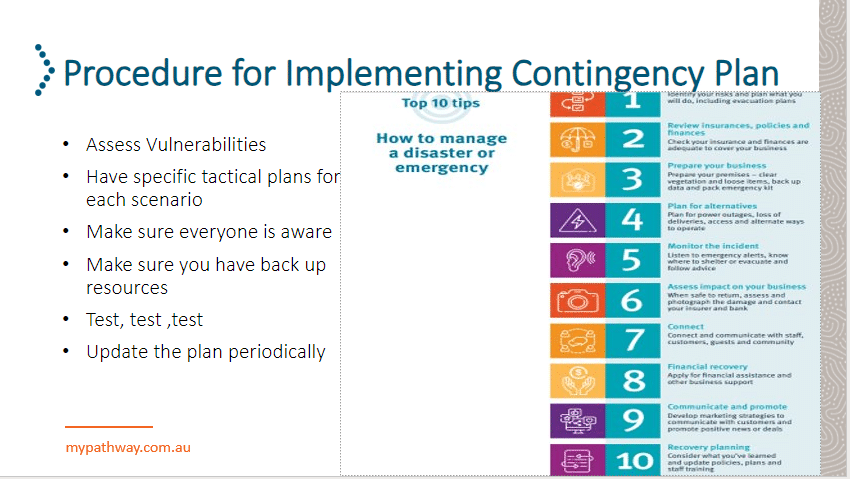

Contingency/ Disaster Planning

Contingency planning is all about being proactive rather than reactive. The marketplace is anything but stable. There are many internal and external risks that can affect business. A contingency plan allows you to be ready, in case the unexpected happens, allowing the business to recover as quickly as possible.

When creating a contingency plan or “disaster plan”, the first thing you need to do is:

- identify every possible scenario that might happen that may affect your business.

- Consider what actions you will need to take for each of these possible risks.

- Communicate and train all stakeholders that it affects.

- Ensure you have the resources available to support your disaster plan.

- Practice, practice, practice.

An example of a contingency plan is an Emergency Evacuation Plan.

- The risk identified is a fire.

- The assessment of risk is you identifying the nearest exits, fire alarms and extinguishers.

- You control the risk by communicating through signage, training your staff, and servicing the equipment and you

- monitor and review by conducting regular fire drills to ensure everyone performs the task correctly.

You Identify, Assess, Control and Review the risks. This contingency plan means you are ready to take action in the unlikely event of a fire in your workplace. You are ensuring the health and safety of your staff in accordance with WHS legislation.

➡Review Knowledge Question 10

Seek advice from Specialists

Now you have conducted your research, you may have identified some areas of the business you need some professional or specialist support.

So who can you use?

- How do they charge?

- How much do they cost?

- What services can they offer you?

Click on these links to find out more:

➡Review Knowledge Question 7

Can you name any Legislation, regulations, standards or codes of practice that apply to your business?

One law that affects most businesses is Australian Taxation Law. Many of you have registered your business name, applied for an ABN. Why? What legislation are you following?

Click on the link below to help you with Question 8.

Workplace Procedures

It is imperative that you have a basic knowledge of all laws that affect your business.

Writing and implementing policies and procedures will ensure you have some systems in place to keep you from inadvertently breaking the law or even hurting someone.

Procedures are HOW you will make it happen.

Figure 01:

- Identify the risk- this can be achieved by conducting a regular risk analysis.

- Assess the risk- use the risk matrix to determine the priority and urgency.

- Control the risk- through training, procedures, supplying PPE.

- Review- Conduct regular training, safety drills, have meetings.

➡Review Question 10

How to complete your Risk Assessment Table

Step 1- Refer to your Small Business Plan

Step 2- Look at your Management plan and identify an internal or external risk that may happen.

Step 3- write this risk in the first column under “Management Plan”

| Risk identified | Internal or External | Likelihood and impact level

(Low, Med, High, Critical) (Refer above table) |

What contingency plans/actions should be implemented to minimise risk? | List relevant stakeholders to assist with contingency planning | |

| 1 | Management plan

e.g failure to lodge BAS statement on time

______________________________ |

||||

Step 4- Is this risk internal or external?

Step 5.- Use the Risk Assessment Matrix to determine if the Likelihood versus Impact of the risk is Low, Medium or High.

Step 6- state what actions or plans you will implement to minimise or eliminate the risk.

Step 7. list who can help you with this risk management planning.

Step 8.- Refer to your Marketing plan and identify a risk to do with Marketing, and so on.

The risk you identify in the first column must relate to the specified section of your business plan. Use your Business plan as a reference.

Refer to Risk Management tab to assist you

Calculating Prices-Task 2b

When calculating your prices, it is generally easier if you have a product to sell because you know the costs and then you add a mark-up or margin on top to determine your price. You also compare your competitors’ prices and look at your target market to see what motivates them to buy, before deciding on what strategy you will use.

However, how do you determine your prices if you have a service?

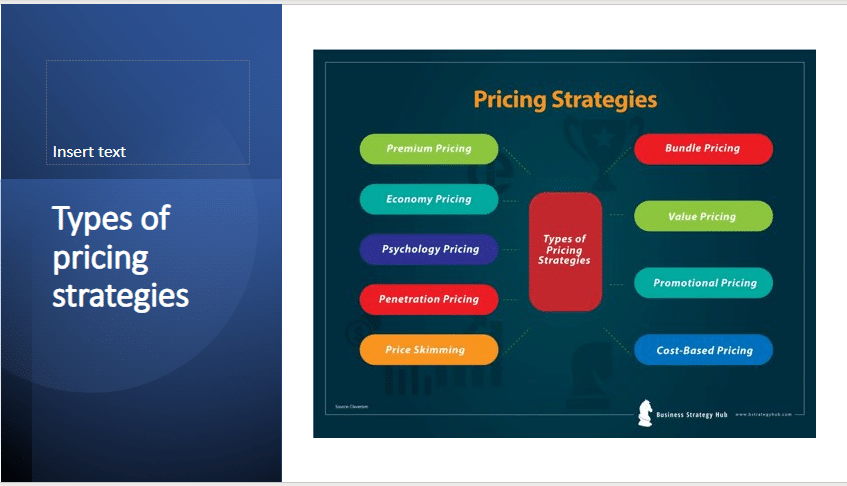

Pricing strategies and Tactics-Task 2c

Pricing strategies refer to the processes and methods used to set prices. There are different pricing strategies which will help you determine the best price for your product and your target market.

Task 2d- Table

The following links below offer information on each section of this task. Click on boxes below to learn more:

How to calculate your Market Size

Market size = number of target users X purchases expected in a given time

- Use data and research to establish the size of your target market. example: there are 5000 people in your desired age bracket and location.

- Consider how many competitors you have and what is a realistic percentage of these people that you can expect to attract to your business. example: You estimate you can realistically gain 20% of the 5000. Your number of target users is 1000 people.

- You expect them to visit your business 3 times a year, average total spend per person is $300. Your estimated market size is 1000 people at $300 = $300 000 per year.

Document 4- Assessment 3- Business Plan Instructions

- Write your full name on the top of the first page “Participant name:”

- Attach a completed copy of your Small Business Plan as requested.

- Attach the completed parts of your Financial Plan that are requested.

Check off the Assessment Submission Checklist

This will ensure you have completed all tasks and paperwork correctly and we won’t need to return anything before marking.

News feed